Since the formation of

the Irish State in 1922, financial sources for the maintenance and development

of the state as an independent entity have been in decline. This has arisen

through Ireland’s joining the EEC in 1973 and subsequent Treaties of the EU, to

successive governments’ neo-liberal economic policies that gradually reduced

the role and income of the state. Contributing to these problems was the loss

of fiscal autonomy when Ireland joined the eurozone in 2002.

Sources of income such as customs duties and charges, fisheries, agriculture, oil and gas, and minerals were all affected in different ways, leaving the increasing taxation of the people as the main plank of the government’s policy to extricate itself from the economic crisis. Since the banking crisis of 2008, government borrowing has increased the national debt from € 50.4 billion to € 119.1 billion in 2011, more than doubling it in a few short years.

Fisheries

The establishment of a

customs union (a free trade area with a common external tariff) was one of the

main aims of the EEC. On joining the EEC in 1973, the Irish government lost

import duties as a source of income from its main trading partners. Three years

later, in 1976, the EEC extended its fishing waters from 12 miles to 200 miles

under the Common Fisheries Policy when it was agreed that fishermen

from any state should have access to all waters. Thus, while Ireland owns 23% of the fishing waters in Europe, it is only allowed 3% of

the European fish trade quota.

Agriculture

Since joining the EEC

there has been ongoing change in Irish farming but “with fewer and larger farms,

less employment, more specialisation and concentration of production and growth

in part-time farming” yet “agricultural output remains at about the level of 20

years ago”. As a source of employment farming has been in decline for a long

time, about 24 per cent in the period from 1980 to 1991 and a further 17 per

cent between 1991 and 2000. Recent demonstrations by farming families in Dublin

have shown the negative effect of government cutbacks, increased costs and

taxes. According to a recent Irish Times article, “the protest was called to

highlight concerns about planned reforms to the Common Agricultural Policy and

the upcoming budget. It also highlighted the margins being taken by supermarket

chains at the expense of farmers. Placard messages included ‘No Cap cuts; no

farm cuts; no extra costs; regulate the retailers.’”

Forestry

More short-sighted

policies can be seen in reports that the State is “also considering

selling off some assets of the forestry body Coillte (The Irish Forestry Board)”

to private investors. Coillte was established under the Forestry

Act 1988, and the company is a private limited company registered under and

subject to the Companies Acts 1963-86. All of the shares in the company are

held by the Minister for Agriculture, Fisheries and Food and the Minister for

Finance on behalf of the Irish State. Profits have increased from a loss of

€438K (1989) to profits of €4.2 million (2009). Moreover, the company employs approx 1,100 people and owns

over 445,000 hectares of land, about 7% of the land cover of Ireland.

More

state assets

In the same article, plans to sell off other state assets

such as parts of Bord Gáis (Gas Board) and ESB (Electricity Supply Board) and “its

25 per cent shareholding in Aer Lingus” were also being considered.

According to Sinn Féin’s

deputy leader and spokesperson for public expenditure and reform, Mary Lou McDonald, “Both the ESB and Bord Gáis are

wealth generating self-financing companies that have invested heavily in first

world energy infrastructure across the island and created thousands of good

jobs benefiting hundreds of thousands of families over the decades”. She added,

““Fine Gael and Labour’s decision to treat the profitable elements of these

companies as a cash cow for bank debt reduction makes no economic sense and

reflects the kind of short term policy and political decision making that got

us into this economic mess in the first place.”

Mining

The extent to which the

Irish Government has bent over backwards to attract foreign investment in

mining - and in the process delimit its share of potential income - can be seen

in an extract from a Government Report titled ‘Land of Mineral Opportunities’, published in May 2006. “Tax

incentives relevant to exploration and mining in Ireland include:

*No State Shareholding

in the Project and No Royalties are Payable to the State.

*Immediate write-off of

development and exploration expenditure

*Corporation Tax of 25

percent (reducing to 12.5% for downstream manufacturing)

*Capital Allowance of up

to 120 percent

*Expenditure on

rehabilitation of mine sites after closure is tax-deductible

*There are no

restrictions on foreign investment in Ireland,

*There are no

restrictions with capital repatriation from the State.”

Oil

and Natural Gas

Over the past 15 years gas and oil have been discovered under Irish waters in the Atlantic Ocean. However, the government’s “Minister

Ray Burke (later jailed for corruption) changed the law in 1987, reducing the

State’s share in our offshore oil and gas from 50% to zero and abolishing

royalties. In 1992, Minister Bertie Ahern reduced the tax rate for the profits

made from the sale of these resources from 50% to 25%.” In May of this year

[2012], an article by economist Colm Rapple stated that

a committee that included 12 TDs [MPs] and senators from Government parties and

nine from the opposition thought that “the terms at which we give away rights

to potential offshore oil and gas reserves are far too generous. […] They want

far tougher terms applied to all new licences.”

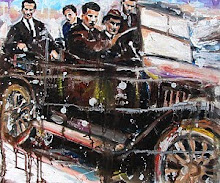

Patrick Pearse (1879-1916)

2016

2016

So how will the

government square this dismal history of giveaways with the upcoming centenary

of the 1916 Rising in 2016, an attempted revolution which was initiated with a proclamation read out in the centre of Dublin

declaring “the right of the people of

Ireland to the ownership of Ireland, and to the unfettered control of Irish

destinies, to be sovereign and indefeasible. The long usurpation of that right

by a foreign people and government has not extinguished the right, nor can it

ever be extinguished except by the destruction of the Irish people.”

This

declaration was followed up in 1922 with The Constitution of the

Irish Free State (Saorstát Eireann) Act, 1922 which stated in Article 11 that “All

the lands and waters, mines and minerals, within the territory of the Irish

Free State hitherto vested in the State, or any department thereof, or held for

the public use or benefit, and also all the natural resources of the same

territory (including the air and all forms of potential energy), and also all

royalties and franchises within that territory shall, from and after the date

of the coming into operation of this constitution, belong to the Irish Free

State”.

The future?

There

seems to be no limit to the government’s sticky fingers. The National

Pensions Reserve Fund has seen its total value reduce from €24.4 billion

in 2010 to € 15.1

billion in 2012 with €20.7 billion of the fund spent on preference shares and ordinary shares in Allied

Irish Banks and Bank of Ireland since 2009. As the government props up the

banks and pays off unsecured bondholders, it is likely that the forthcoming

significant national commemorations will refocus the Irish people on past

conceptions of national democracy. Chicken, anybody?

No comments:

Post a Comment