The recent article

League of Nationalists in The Economist

(19-11-2016, pps. 51-54) sets out to answer the question: “All around the

world, nationalists are gaining ground. Why?”

Despite noting that “many

countries are shifting from the universal, civic nationalism towards the

blood-and-soil, ethnic sort”, the authors agree that “comparisons with the

1930s are fatuous.”

The authors also

argue that “as positive patriotism warps into negative nationalism, solidarity

is mutating into distrust of minorities”. It could also be argued that, with

the election of Trump, negative nationalism [Bushism] is warping into positive

patriotism [Trumpism] as Americans demand that their multinational corporations

be held accountable for their evasion of their responsibilities to the state which

they managed through the creation of tariff free areas [in the past state

income consisted of up to 90% of tariffs], export of jobs [outsourcing] and tax reductions [in Ireland their taxes had

been reduced to as little as 2%].

According to the

article:

“Many westerners, particularly older ones, liked their countries as they

were and never asked for the immigration that turned Europe more Muslim and

America less white and Protestant. They object to their discomfort being

dismissed as racism.”

They liked their

countries as they were before when their countries were less indebted, less

involved in military activities abroad and basic services did not roll from

crisis to crisis. After all, it was not their decision to be re-designated

‘consumer’ rather than ‘citizen’.

They also write:

“Western voters aged 60 and over – the most national cohort – have lived

through a faster cultural and economic overhaul than any previous generation,

and seem to have had enough.”

It is true they have

had enough. They have seen university fees and taxes going up and social services

going down. They have seen through immigration as mainly facilitating military

adventurism abroad. They are long in the tooth enough to know that there is no

real democracy in the EU. They want to wrest control of their society back into

their own hands for their future and the future of their naive iphone obsessed

children. Maybe for the first time in their lives they have made a political

decision that was actually in accordance with all the realisations they have

had over the years but never acted upon.

They do “dislike the balkanisation of their countries into identity groups” as they grew up with concepts like that of the ‘citizen’ where all were equal before the state in the social contract of rights and responsibilities.

These ‘nationalists’

are contrasted with liberals whose “two sources of identity: being a good global

citizen (who cares about climate change and sweatshops in Bangladesh) and

belonging to an identity group that has nothing to do with the nation

(Hispanic, gay, Buddhist, etc).” Liberals stress non-nationalist identities and welcoming in immigrants. This

is laudatory except they do this without questioning why the immigrants are

coming in and doing something about it or else they support the wars of

dominance that result in the mass migrations of their victims to safe havens

away from the ‘dictators’. The liberal dislike of any state control makes them

easy prey to those who really couldn’t care less if Bashar al-Assad, for

example, is a ‘dictator’ or not, but, rather whose geopolitical side he is

dictating on.

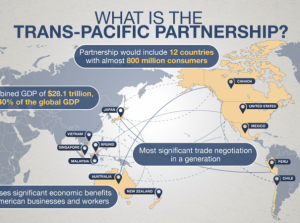

Some populist leaders

supporting Brexit tend to emphasise the objectives of ordinary people but

studiously avoid the agenda of the 1%. They avoid discussing the geopolitical

alignments and re-alignments of their political masters, their agendas for

global domination, their constant creation of new free trade areas, their

endless sourcing out to the cheapest labour

costs in the world, their unceasing seeking out of the lowest taxation on their

profits and their control of the media and the banks everywhere.

These populists

misrepresent people as having narrow concerns like the future of their pensions

or racist fears of immigrants ‘taking our jobs’. They seek to rile up anger to

gain support for narrow right-wing ends. For the liberals any questioning of

the weakness of the state is perceived to be a movement towards ‘fascism’. However, they miss the point. Unlike the liberals, the working class is

not afraid of a strong state. People want a state that protects their jobs,

strong borders that keep out criminals, and decent health and education systems

that their taxes are supposed to be paying for.

The vote for Trump proves that

ordinary people are very well aware of the negative sides of neo-liberalism.

Trump has talked about bringing jobs home, controlling immigration, investment

in infrastructure and creating a stronger pro-people state and the people

supported him. The people are also well aware that the liberal cry that

‘governments can’t do anything about growth’ is a sleight of hand when it is no

secret that neo-liberals are doing their damnedest to reduce the power of the

state in the first place.

The Economist article sub-heading

‘Nations once again’ refers to the poem A

Nation Once Again by the Irish poet Thomas Davis who calls on the Irish

people to throw off colonialism and take control of their own destiny. However,

the article makes a jump from the nationalism, ‘controlling one’s destiny’,

referred to in the sub-heading to a ‘better question’: “what turns civic

nationalism into the exclusive sort?”. To want jobs and better services at home

and an end to meddling in other people’s countries and economies is anathema to

the freedom of the neo-liberal elites to do whatever they like around the world

maximizing profits and monopolizing control of world markets.

Sure,

Brexit and the Trump election are good examples of passive politics, of people sitting

back, casting a vote and hoping for the best, or at least better. There is

nothing new in this, it may even be a case of ‘we pretend to vote and you

pretend to lead’. In the past the dangers of passive politics were pointed out

by various writers such as James Connolly who wrote: “If the national movement of our day is not

merely to re-enact the old sad tragedies of our past history, it must show

itself capable of rising to the exigencies of the moment.”[1]

Frantz Fanon

also pointed this out in The Wretched of the Earth:

“We have seen […]

that nationalism, that magnificent song that made the people rise against their

oppressors, stops short, falters and dies away on the day that independence is

proclaimed. Nationalism is not a political doctrine, nor a programme. If you

really want your country to avoid regression, or at best halts and

uncertainties, a rapid step must be taken from national consciousness to

political and social consciousness.”[2]

Jean-Jacques

Rousseau was aware of the dangers of passive politics. He advocated a more proactive approach of continual political

activity. He wrote,

(notwithstanding the existence of slavery at the time), “[a]mong the Greeks,

whatever the people had to do, they did themselves; they were constantly

assembled in the market place.”[3]

It

is likely that Trump will disappoint his supporters given the limitations of

his new position but the possibilities for change signaled by Trump should give

people hope and make them realise that only by getting out on the streets and

showing their strength in numbers, choosing their own representatives and

leaders and demanding change will anything progress.

[1]

P. Beresford Ellis, ed., James Connolly: Selected Writings (Middlesex:

Pellican, 1973) 121.

[2]

Frantz Fanon, The Wretched of the Earth (London: Penguin, 1990) 163.

[3]

Jean-Jacques Rousseau, The Social Contract or Principles of Political Right

[1762] (Hertfordshire: Wordsworth Editions Ltd., 1998) 45.