Tariffs and Taxes

“Before

the income tax was imposed on us just 80 years ago, government had no

claim to our income. Only sales, excise, and tariff taxes were allowed.”

Alan Keyes

Free trade

areas and free trade agreements have allowed for the growth of

multinational corporations but the concomitant reductions in tariffs

caused a decline in income for the states involved.

Tariffs are

defined as “a tax imposed on the import or export of goods. In general

parlance, however, it refers to “import duties” charged at the time

goods are imported. Tariffs have three primary functions: to serve as a

source of revenue, to protect domestic industries, and to remedy trade

distortions (punitive function).”

As tariff

income declined income taxes and payroll taxes increased. In many cases

workers also objected to reductions in tariffs as cheap imports had

deleterious effects on their industries and jobs.

In the USA the changing proportions of government income since 1792 can be seen clearly in this table.

The percentage of Federal Government income from tariffs ranged from

25.4% to as high as 95.0% between 1792 and 1910. With the passage of

the 16th Amendment income

taxes began in 1913 and the percentage of Federal Government income

from tariffs quickly declined to 6.1% by 1940. In that year payroll taxes were

also introduced and by 1955 the percentage of Federal Government income

from tariffs declined to 0.8%. Between 1955 and 2010 the percentage has

hovered around 1.3%. Since then it has averaged out

to about 1.7%. As income declined from tariffs, the state very quickly

filled in the gap, moving the burden of taxation very substantially from

industry in general to workers in particular. Also, during the 1930s

and 1940s the wealthy paid high taxes:

“And then, in 1945, with the country loaded to the gills with war debts, the top bracket hit an all-time high: 94%. This was assessed on anyone making more than $200,000. The following year, 1946, rates were trimmed a bit. The top rate was reduced to 91%. And taxes stayed pretty much just that way for the next 15 years, until the early 1960s. Importantly, this was one of the most successful eras in US economic history. The middle class boomed, the economy boomed, and the stock market boomed. And all with the top marginal income tax rate over 90%.”

However, by

the early 1960s, the high rates for the wealthy in the US began to drop,

declining to 70%, then 50% in the 1980s to around 35% now.

When the state

is denied or limited sources of income from taxation on production it

falls back on taxing people in more and more varied and imaginative ways

to counter the shortfall. According to one commentator,

“Americans will fork over nearly 30 percent of what they earn to pay

their income taxes, but that is only a small part of the story. As you

will see below, there are dozens of other taxes that Americans pay every

year. Of course not everyone pays all of these taxes, but without a

doubt we are all being taxed into oblivion. It is like death by a

thousand paper cuts.” The author then lists 97 taxes Americans pay every

year.

Free Trade Agreements

The

increase in personal taxation went hand in hand with job losses as free

trade agreements allowed for cheap imports even by companies that had

once formerly been national employers. The long term effects of tariff

reductions in the North American Free Trade Agreement (NAFTA), for

example, which went into effect on January 1, 1994, are described thus:

“American manufacturing jobs were lost as U.S. firms used NAFTA’s new foreign investor privileges to relocate production to Mexico to take advantage of that country’s lower wages and weaker environmental standards. U.S. job erosion worsened as a new flood of NAFTA imports swamped gains in exports, creating a massive new trade deficit that equated to an estimated net loss of one million U.S. jobs by 2004.”

Similar discussions are currently taking place regarding the Transatlantic Trade and Investment Partnership (TTIP):

“In concrete terms the EU and the US have made substantial progress on market access for EU and US companies in all three areas meaning: tariffs, services and public procurement. [A] [s]econd tariff offer was exchanged, so both sides now arrived at a comparable level of proposals in terms of tariff line coverage which would facilitate further talks.”

As the list of bilateral and multilateral agreements

gets longer and longer, states fall ever deeper into debt and MNCs

(multinational corporations) increase their profits exponentially.

The global

search for cheaper labour costs and the lowest taxation on corporate

profits has made some companies richer than countries. One writer noted that:

“Corporate

America has more cash than the economies of Belgium and Sweden combined.

S&P 500 companies, excluding financial companies, collectively had

$1.43 trillion in cash reserves sitting on the sidelines in the second

quarter (April to June) of this year [2015], according to FactSet.

That’s the second highest level in 10 years, and just a tad lower than

the highest — $1.45 trillion — set in the fourth quarter last year.”

Tax avoidance

Some companies have used corporate inversion, tax havens, transfer pricing, tax avoidance etc. to bump up profits even more. Citizens for Tax Justice notes the differences between corporations and domestic business and the repercussions this has on society in general:

“U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses or individuals when it comes to the tax code. Rather than paying their fair share, many multinational corporations use accounting tricks to pretend for tax purposes that a substantial portion of their profits are generated in offshore tax havens, countries with minimal or no taxes where a company’s presence may be as little as a mailbox. Multinational corporations’ use of tax havens allows them to avoid an estimated $90 billion in federal income taxes each year. Congress, by failing to take action to end to this tax avoidance, forces ordinary Americans to make up the difference. Every dollar in taxes that corporations avoid by using tax havens must be balanced by higher taxes on individuals, cuts to public investments and public services, or increased federal debt.”

Once again,

tax avoidance by MNCs affects public services and investment in

infrastructure. This avoidance extends to the wealthy who own these

companies. The recent revelations of

the Panama Papers show the extent of tax avoidance by wealthy

individuals is having a knock-on effect on states and societies starved

of tax income:

“The Panama Papers [a one-year investigation by over 100 reporters worldwide], containing info on thousands of shell companies set up to avoid taxes and hide assets for over four decades from 1977 to 2015, are all about millionaires and billionaires and the politically connected “sticking it to” average citizens of the world by hiding money from fellow countrymen’s taxation policies and/or theft of state funds and laundering money.”

The Social Contract

While

corporations can move around the world, states are fixed and the

producers of goods live in societies that need to provide education

systems, transport systems, communications systems, health systems,

social welfare systems, houses, food, traffic lights, etc. that all cost

a lot of money.

The legitimacy of authority of the state over the individual derives from general acceptance of the social contract:

“Social contract arguments typically posit that individuals have

consented, either explicitly or tacitly, to surrender some of their

freedoms and submit to the authority of the ruler or magistrate (or to

the decision of a majority), in exchange for protection of their

remaining rights.” The lack of social justice apparent in the increasing

gap between wealthy elites and ordinary people can break down, and

result in disorder, looting and rioting. In a worst case scenario there

is the possibility of governmental collapse and the creation of a failed state where basic conditions and responsibilities of a sovereign government no longer function properly.

At the very least, it has been shown in

a book by David Stuckler and Sanjay Basu, “that austerity is now having

a “devastating effect” on public health in Europe and North America.

The mass of data they have mined reveals that more than 10,000

additional suicides and up to a million extra cases of depression have

been recorded across the two continents since governments started

introducing austerity programmes in the aftermath of the crisis.[…] And

in the UK, the authors say, 10,000 families have been pushed into

homelessness following housing benefit cuts. […] Cuts in HIV-prevention

budgets have coincided with a 200% increase in the virus in Greece.”

The

impoverishment of the state through squeezed funds affects the poorest

most as wealthy individuals can easily purchase privatized versions of

state services.

Weakening domestic demand

The imposition

of austerity and cutbacks not only adds to the general misery but also

at the same time reduces demand. One economic research institute looked at the effects of austerity in Ireland:

“Domestic

demand has been hard hit, shrinking by almost a quarter. Though the

export sector has not been hit as hard, the lack of investment in public

infrastructure reduces the potential of this sector to grow in the

years to come. Also a reflection of the weak state of the economy has

been price deflation. Between September 2008 and January 2010 prices

fell. Though inflation is not of itself a good thing, the fact that it

has been so low for so long is a reflection of the weak state of

domestic demand. Though there was a brief spell of deflation immediately

following the Second World War, one must go back to 1933 to see an

instance of deflation as severe as that which has recently occurred in

Ireland.”

The effects of

cutbacks by the state in the form of job cuts, social welfare cuts and

pay reductions is to reduce income for the state (less taxes and VAT)

while at the same time creating a drop in demand as people have less

money to spend on goods. This can be seen generally around Ireland (with

businesses closing down e.g. Cork, Sligo, Galway, Limerick) except in areas where multinational corporations have relocated, accounting for a lot of the much – vaunted Irish ‘recovery’.

According to Eurostat, Ireland now has one of the Eurozone’s poorest living standards:

“The typical German living standard is the highest in Europe while the Irish, Italians and Spanish are among the Eurozone’s poorest, according to data published Wednesday by Eurostat, the EU’s statistics office. […] Eurostat has been highlighting Actual Individual Consumption (AIC) as a measure of living standards and it says that it “consists of goods and services actually consumed by individuals, irrespective of whether these goods and services are purchased and paid for by households, by government, or by non-profit organisations.”

Central Banks wade in

However, the decline in consumption is a global problem and numerous measures have been taken to try and solve it:

“Since 2008, global central banks have cut interest rates 637 times, they have injected 12.3 trillion dollars into the global financial system through various quantitative easing programs, and we have seen an explosion of government debt unlike anything we have ever witnessed before. But despite these unprecedented measures, the global economy is still deeply struggling. This is particularly true in Japan, in South America, and in Europe.”

The

extraordinary success of big capital (aided by the global spread of

neoliberalist policies such as privatization, fiscal austerity,

deregulation and free trade – policies which directly and indirectly

reduced incomes to the state) is sucking society dry, while big capital

itself is sloshing around with never-before-seen levels of liquidity.

The desperation to get some money back into the economy can be seen in a recent statement where

ECB chief Mario Draghi refused to rule out the prospect of ‘helicopter

money’ drops, “the process by which central banks can create money to

transfer to the public or private sector to stimulate economic activity

and spending.”

The role of the state?

New trade

agreement proposals such as TTIP and TPP show that big capital still has

more cards up its sleeve with more tariff reductions on the horizon.

The further liberalization of global trade does not auger well for the

future of financing the state. Only by changing the relationship between

the state and big capital while at the same time reevaluating the role

of the state in society and questioning its sources of funding, can

people protect themselves from the worst excesses of neoliberalism.

Otherwise, the

deepening implementation of ‘austerity’, with its social and economic

ills of job cuts, depression and suicide, will drive a return to a state

where life becomes, in the famous words of Hobbes, “solitary, poor,

nasty, brutish and short”.

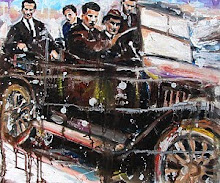

Caoimhghin Ó Croidheáin is

an Irish artist who has exhibited widely around Ireland. His work

consists of paintings based on cityscapes of Dublin, Irish history and

geopolitical themes (http://gaelart.net/).

His blog of critical writing based on cinema, art and politics along

with research on a database of Realist and Social Realist art from

around the world can be viewed country by country at http://gaelart.blogspot.ie/.